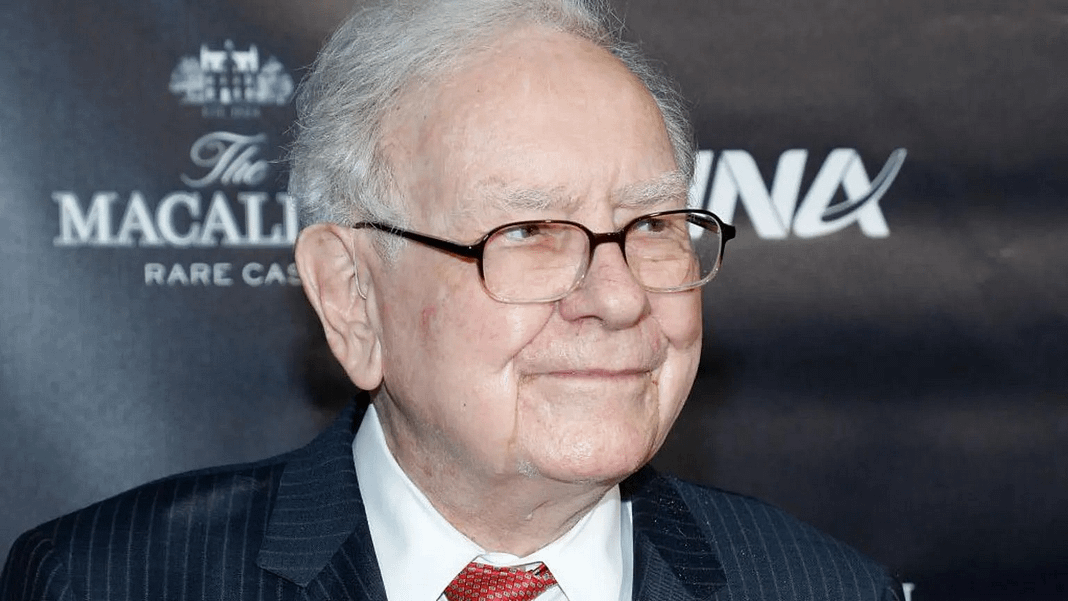

In a historic moment for Wall Street, Warren Buffett, the 94-year-old “Oracle of Omaha,” announced his retirement as CEO of Berkshire Hathaway at the company’s annual shareholder meeting on May 3, 2025. After 60 years at the helm, Buffett will hand over leadership to longtime deputy Greg Abel by year’s end .

The news, met with a standing ovation from 40,000 attendees, marks the end of an era for one of the world’s most successful investors. Here’s what you need to know.

1. The Surprise Announcement

Buffett revealed his decision without warning, stating:

“I think the time has arrived where Greg should become the CEO at year-end.”

Only his children, Howard and Susie Buffett, knew beforehand. Even Abel—seated beside him on stage—was caught off guard .

“Classic Buffett: humble, abrupt, and utterly strategic.”

2. Who Is Greg Abel?

Abel, 62, has been Buffett’s heir apparent since 2021. As vice chairman, he oversees Berkshire’s non-insurance empire, including utilities (like Berkshire Hathaway Energy) and railroads (BNSF) .

Buffett praised Abel’s hands-on leadership:

“Greg can do better at many things than I did.”

Investor takeaway: Expect continuity, but possibly more aggressive deals under Abel.

3. Buffett’s Unshaken Loyalty to Berkshire

Despite stepping down, Buffett vowed:

“I have zero intention of selling one share of Berkshire.”

His $154 billion net worth is largely tied to Berkshire stock, which he plans to donate gradually to charity .

4. A Legacy Like No Other

- Transformed a failing textile mill into a $1.1 trillion conglomerate .

- Iconic investments: Apple, Coca-Cola, Geico, Dairy Queen .

- Philosophy: Long-term value investing, minimal debt, and betting on America .

Apple CEO Tim Cook tweeted:

“There’s never been someone like Warren. He leaves Berkshire in great hands.”

5. Buffett’s Final Warnings

- On Trump’s tariffs: “Trade should not be a weapon. It’s a big mistake.”

- On U.S. debt: “The deficit is unsustainable.”

“Even in retirement, Buffett stays politically fearless—but avoids partisan traps.”

What’s Next for Berkshire?

- Abel’s challenges: Deploying Berkshire’s $347 billion cash pile, navigating global trade tensions .

- Buffett’s role: Remains chairman but cedes operational control .

“The ‘Oracle’ may be stepping back, but his wisdom will echo for decades.”