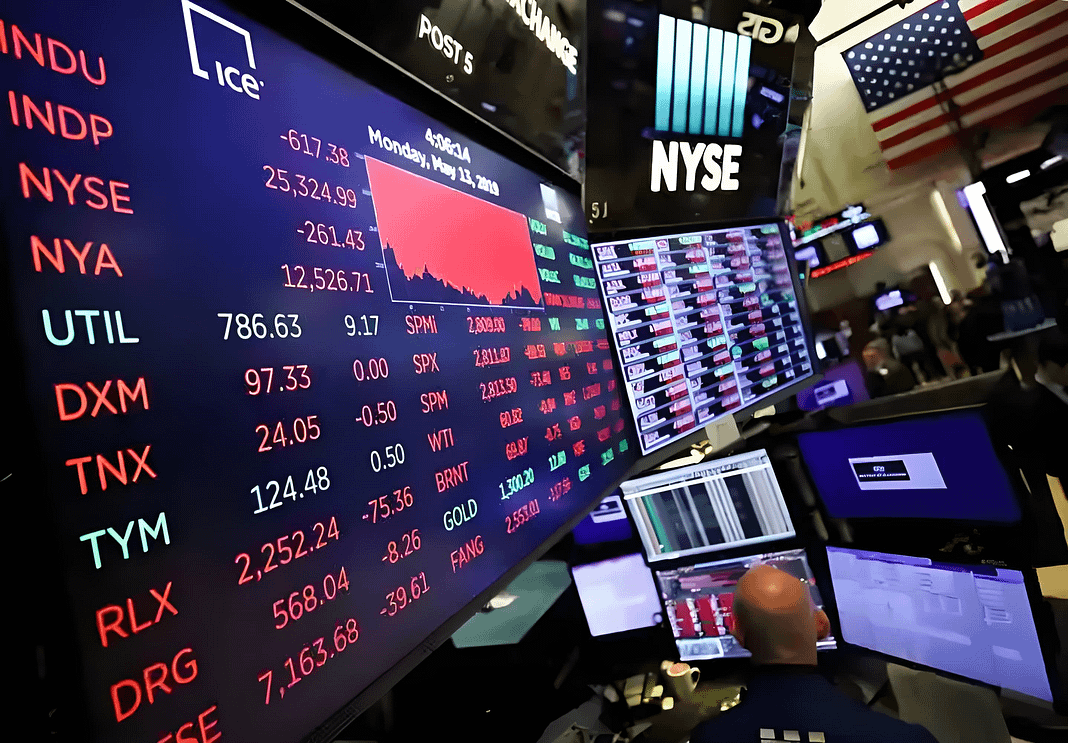

U.S. stock markets delivered a split performance on March 31, 2025, as investors weighed escalating trade tensions against standout corporate events. The Dow Jones Industrial Average gained 1% to close at 42,001.76, while the Nasdaq Composite dipped 0.1% to 17,305.67. The S&P 500 edged up 0.6% to 5,611.85.

Tariff Uncertainty Weighs on Sentiment

Markets remained volatile as President Trump escalated tariffs:

- 25% on Canadian/Mexican imports (effective February 1)

- 20% on Chinese goods (up from 10% on March 4)

Analysts warn these measures could accelerate inflation, with gold hitting record highs as a safe-haven play. Details on country-specific tariffs are expected April 2.

Standout Performers

- Newsmax’s Historic IPO: Shares of the conservative media firm (NYSE: NMAX) skyrocketed 735% from their 10IPOpriceto10 IPO price to 10IPOpriceto83.51, raising 75million.The75 million. The 75million.The300 million total offering marked 2025’s most successful market debut.

- Tesla’s Troubled Quarter: The EV maker lost 36% in Q1 – its worst quarterly drop since 2022 – erasing $460 billion in market value amid slumping European/Chinese sales and CEO Elon Musk’s controversial White House role.

Sector Breakdown

- Winners: Consumer staples (+1.8%), financials (+1.2%)

- Laggards: Tech (-0.7%), autos (-1.1%)

Outlook: Markets await clarity on tariff implementation and March jobs data. The Nasdaq’s underperformance reflects tech’s vulnerability to trade disruptions, while defensive sectors led the Dow’s advance.