When capital giants smell business opportunities, and when short video platforms usher in a “new change”, a potential “marriage” is quietly brewing. Recently, news has revealed that private equity giant Blackstone is considering acquiring a small stake in the US TikTok derivative company. As soon as the news came out, it immediately attracted high attention from the market. Why is Blackstone so fond of TikTok? What impact will this investment have on the short video industry?

TikTok’s “American Past”: Finding a Balance Between “Compliance” and “Growth”

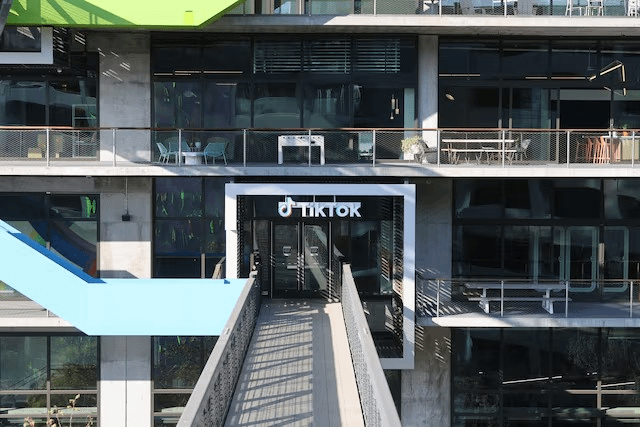

TikTok’s rise in the US market can be described as a dramatic “struggle history”. With its unique algorithm recommendation and massive short video content, TikTok quickly завоевало the hearts of young Americans and became a dazzling new star in the field of social media.

However, with the continuous expansion of the user base, TikTok is also facing increasing regulatory pressure. The US government has taken a series of restrictive measures against TikTok under the pretext of “national security”, and even required it to spin off its US business.

In order to cope with regulatory risks, TikTok has to seek a path of “compliance” and plans to split its US business into a new company. The future of this “American TikTok derivative company” also affects the hearts of countless people.

Blackstone’s “Investment Logic”: Optimistic About TikTok’s “Growth Potential”

As one of the world’s largest private equity investment institutions, Blackstone Group is known for its keen investment acumen and strong capital strength. The reason why Blackstone is considering investing in the US TikTok derivative company is likely to be optimistic about its “growth potential” in the US market.

Despite facing regulatory pressure, TikTok still has a large user base and extremely high user stickiness in the United States. If it can successfully solve the compliance problem and continue to innovate products and services, TikTok still has a lot of room for development in the US market.

The “New War” in the Short Video Industry: The Competitive Landscape May Be Reshaped

Blackstone’s investment in the US TikTok derivative company may also have an impact on the competitive landscape of the short video industry. At present, the short video market has become a red sea, and the competition is extremely fierce. In addition to TikTok, there are many players such as YouTube Shorts and Instagram Reels.

Blackstone’s entry will undoubtedly bring more resources and support to the US TikTok derivative company, thereby enhancing its competitiveness in the market. This may trigger a new round of “war” in the short video industry, and the competitive landscape may face a reshuffle.

Personal Comment: The “Blessing” and “Challenge” of Capital

As an observer, I believe that Blackstone’s investment in the US TikTok derivative company is both an opportunity and a challenge. The blessing of capital can bring more resources and support to TikTok and help it develop better.

However, the profit-seeking nature of capital may also have a negative impact on TikTok’s development. How to adhere to social responsibility and safeguard user interests while pursuing commercial interests will be an important test for TikTok.