1. China’s Strategic Move

- April 2025 Controls: Export licenses now required for dysprosium, terbium (crucial for EVs/jet engines).

- Global Dominance:

- 90% of refined rare earths

- 98% of heavy rare earth processing

- Historical Parallels: 2010 embargo taught the West little—until now.

Our Take:

“This isn’t just about trade—it’s a high-tech chokehold. No dysprosium? Say goodbye to F-35 upgrades.”

2. Australia’s Counterplay

✅ Resource Wealth:

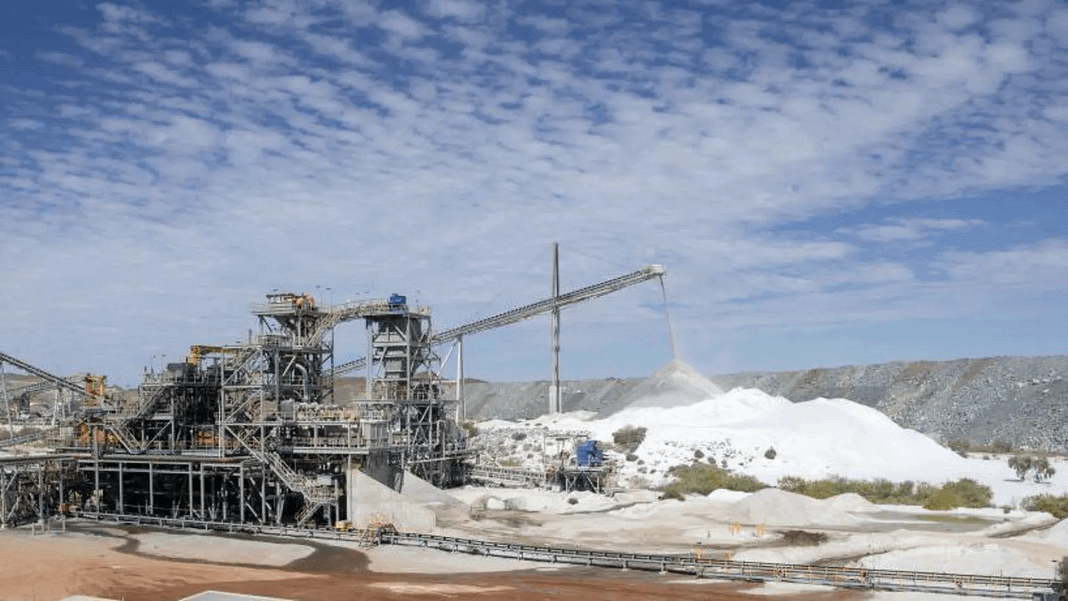

- Lynas (ASX:LYC): Only major non-Chinese separator of light REEs.

- Nolans Project: Holds 5% of global neodymium reserves.

✅ Government Action:

- A$1.2B Strategic Reserve (Albanese’s April pledge).

- Fast-tracking Arafura’s mine-refinery combo (2026 target).

✅ Market Response:

- ASX rare earth stocks surged 20%+, betting on Western reshoring.

But Here’s the Catch:

Australia ships 80% of its raw ore to China for refining—like selling wheat but buying back flour.

3. The Refining Roadblock

- Tech Deficit: China’s 30-year lead in solvent extraction techniques.

- Cost Crisis:

- Australian labor costs: 5× China’s

- Zero-discharge raises capital costs by 40%.

- Missing Links:

- No commercial-scale dysprosium purification.

- Magnet manufacturing? Still in pilot phases.

Expert Reality Check:

“Even if Australia hits its 2030 targets, China could flood the market and bankrupt new refiners overnight.” — Prof. Timothy Williams

4. Geopolitical Tightrope

- US Alliance: Pentagon’s Defense Production Act funds Australian projects.

- China Dependence:

- 70% of Australia’s iron ore goes to China.

- Rare earth decoupling risks retaliatory tariffs.

Irony Alert:

Lynas’ radioactive waste scandal in Malaysia shows how hard localization really is.

5. 2030: Make or Break?

- Best Case:

- Japan/Korea invest in Vietnamese processing hubs.

- US subsidies offset high costs.

- Worst Case:

- China lifts restrictions, triggering price collapse.

- Green protests halt new mines.

Final Verdict:

Australia will remain a dig-and-ship economy until the West commits Vietnam War-level funding. Otherwise, Beijing’s monopoly is unshakable.